The investment in employee share plans by Hong Kong-listed companies continues to increase, according to our latest research "Industry benchmark report: Employee share plans for Hong Kong listed companies" Our most recent findings show that in 2022 Hong Kong Listed companies invested an impressive HK$72 billion in share schemes.

Information Technology (IT) and healthcare are the top industries adopting employee share plans among Hong Kong-listed companies. IT was the largest investor at HK$38 billion, more than half of the total investment across industries at 53.5%.

Healthcare was second in terms of their investment in employee share plans at HK$11.5 billion.

In third place were companies in the consumer discretionary sector, those that offer non-essential goods and services, at HK$9.7 billion.

Top 3 annual employee share plan investment by sector in $HK

$38.5B

Information Technology

$11.5B

Healthcare

$9.7B

Consumer discretionary

Most popular types of employee share plans

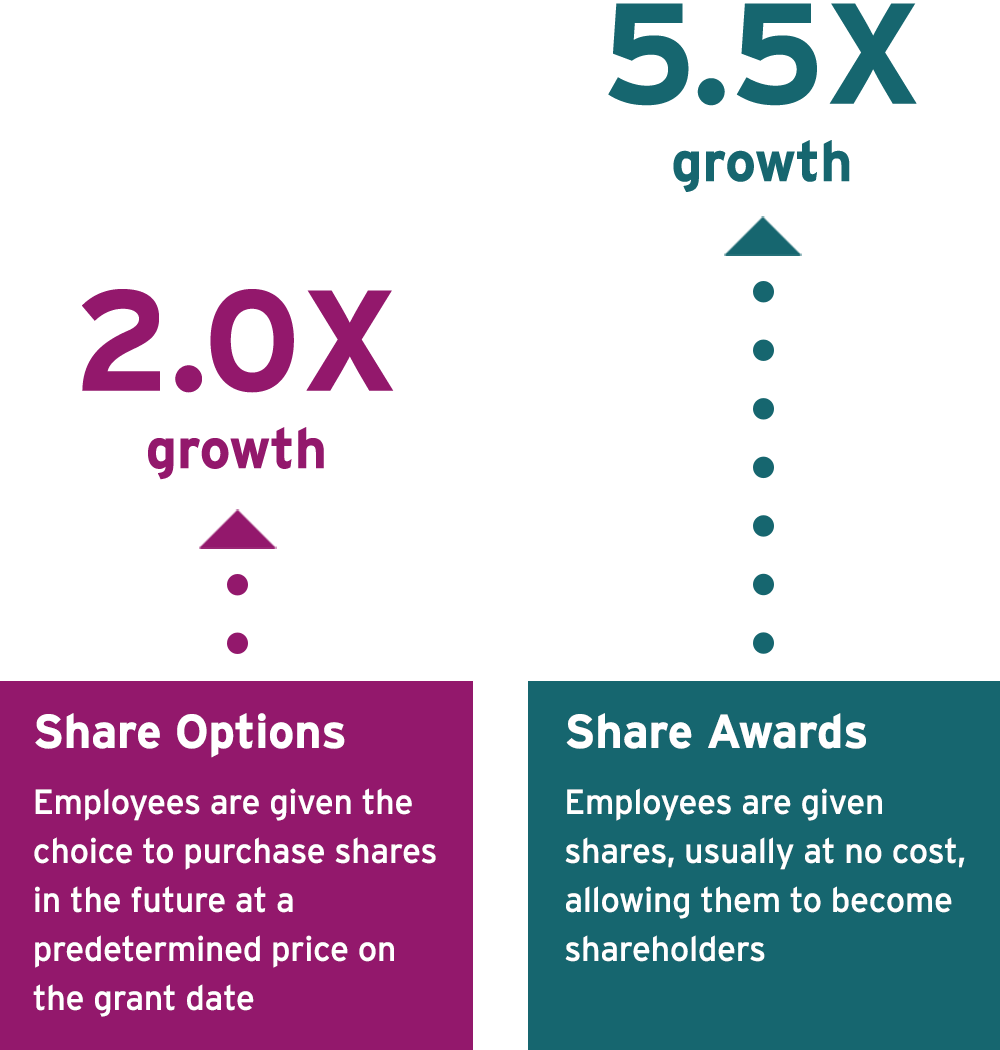

The two most prevalent employee share plan schemes among Hong Kong-listed companies are share options and share awards, with share awards growing at a faster rate over that past decade.

Healthcare and IT show the highest adoption rate of share award schemes across industries analysed, with 58.7% and 46.6% respectively.

Share awards are typically used by companies in highly competitive industries with high turnover rates, like IT and healthcare, as a way to attract, retain and motivate the best talent. These companies have a broader business strategy for the mid- to long-term and want to ensure a stable employee base to reach their goals.

Share options continue to outpace share awards across all industries, with the highest adoption rates in Conglomerates at 88% and Consumer Discretionary at 85.8%.

Company size and strategic goals

In addition to how different industries are using employee share plans, company size can also affect how these schemes are being implemented as part of compensation programs to align with the company’s strategic goals.

Larger and more mature companies are using share options for their executive teams as a tool to drive growth by aligning these awards with the organisation’s financial performance. Most executive plans are performance-based, and the share options they receive are tied to their achievement of specific goals and objectives.

Share options are also used by newly listed companies that are in a growth phase. These firms usually have limited cash on hand for salaries and use share options to attract the talent they need.

In both cases the incentive is to work hard to increase the share price, which in turn increases the rewards.

As company size increases, so does the use of share awards. Larger companies generally offer a more diversified range of schemes that include both share awards and share options. With a larger employee base and more people at varying levels of seniority, providing more than one scheme allows the company to address the varying needs of specific employee populations.

Enter your email address below to download the Industry Benchmark Report