Computershare acts as transfer agent/registrar to a range of US companies. For these companies, registered shareholders can manage their own holdings directly using our online platform, Investor Center.

Shareholders who currently own shares in these companies through a broker/intermediary (beneficial shareholders) can become registered shareholders and manage their holding through Investor Center by following these steps:

- Let your broker/intermediary know you would like to transfer your shares into registered ownership format

- Your broker/intermediary should then instruct the Depository Trust Company (DTC) to electronically transfer the shares/stock from DTC's nominee acting on behalf of the brokerage/intermediary into your own name at Computershare

- If you do not already have an account, you can register to use our Investor Center for free online

- Upon transfer of shares/stock to your own name, Computershare will send you a statement by mail to confirm you are a registered shareholder. For new users, this statement is required to log in to Investor Center for the first time. For existing users, your shares will be visible via Investor Center as soon as the transfer is processed by Computershare.

Please note that although Computershare does not charge investors for the transfer of shares into registered ownership, brokers/intermediaries may. You should ensure you understand what those fees are before initiating the process.

You can also become a registered shareholder by buying stock directly through Computershare online using our Investor Center.

Frequently Asked Questions

Index

- Direct Registration System (DRS)

- Registered and beneficial shareholders

- Investor Center

- Transferring shares/stock from your broker to DRS

- International shareholders

- Questions about your shares in DRS at Computershare

- Shareholder communications

- Individual Retirement Account (IRA)

- Direct Stock Purchase Plan (DSPP)

- About Computershare

- Questions about specific companies

- Questions about GameStop warrants

- Depository Trust Company (DTC)

- Regulatory

- Other questions (misc)

- ☆ New questions

Use the index to quickly move to a section of the FAQs. Additionally, using your browser's search function (ctrl/F or ⌘F) can help find answers to your questions. If you can't find the information you're looking for, you can try our Live Chat.

Direct Registration System (DRS)

What is the Direct Registration System (DRS)?

DRS allows registered shares to be held in electronic form without having a physical security certificate issued as evidence of ownership.

Do I need an Investor Center account to be registered via DRS?

No. Investors do not need an account with Computershare in order to be registered via DRS.

Can I use the DRS if I live outside the US?

Yes. Additionally, if your broker/intermediary is a participant of the Depository Trust Company (DTC), they will be able to deposit your shares into DTC (removing your name as a registered shareholder from the register) or withdraw shares from DTC (adding your name as a registered shareholder), electronically. Otherwise your broker/intermediary will need to arrange this via its commercial relationship with a DTC participant (if it has one) to give effect to such transfers electronically. Failing that, a physical transfer form may be required, which may necessitate a medallion guarantee to verify the transferring party's signature. Medallion guarantees may be difficult to obtain outside the US.

Is there a limit to how many accounts Computershare can create in a particular timeframe?

Account creation is an automated process at Computershare. Our systems are resilient and perform effectively during periods of both low and exceptionally high demand. We are not currently experiencing, nor do we envisage any delays in the processing of transfers, including transfers to DRS and account opening.

Can I receive a share certificate?

In some instances, although higher DTC withdrawal fees may apply. Typically, companies register investors into a DRS holding by default. Some companies have stopped issuing share certificates and only allow book-entry shares to be issued and maintained on the register.

Is it possible for a third party to ‘reverse’ my directly registered shareholdings into beneficial ownership without my consent?

No. Shareholders can themselves choose to move directly registered shares into beneficial ownership through an intermediary such as a broker. To do this, shareholders should instruct the transfer agent (such as Computershare) to deposit their shares into DTCC form and submit a signed and indemnified transfer form identifying the receiving broker. Computershare will not act upon any instruction to transfer directly registered shares into beneficial form without this form signed by the shareholder. In addition, Computershare needs the relevant account numbers to perform such an instruction. We recommend not disclosing account numbers to third parties as an additional security measure.

We noticed a growing interest among shareholders of particular companies in leveraging the Direct Registration System (DRS) and the registration process with transfer agents to safeguard their investments against short-selling malpractices. Should this indeed be one of the primary considerations for investors when registering their shares with their transfer agent?

This may be a relevant consideration for investors. For some investors in certain companies, this is their primary objective.

Other objectives include safeguarding the asset by maintaining it in the investor’s own name and maintaining a direct relationship with the underlying issuer. The benefits of this include improved turnaround times for receipt of materials from the company, such as proxy forms and meeting materials.

Can you please explain what “effective clearing and settlement” is and what would happen if you didn’t have enough shares for operational efficiency?

- When you hold shares with the settlement broker, it can improve process efficiency, including processing steps and handling times, cost reduction, etc.

- Shares held at the broker are maintained in an account in the name of Computershare.

- Dingo & Co is a nominee for Computershare in its role as a transfer agent for its issuer clients and is solely used internally at Computershare.

- In the unlikely event of insufficient shares in the Computershare account at the broker for settlement purposes, Computershare will requisition the amount of additional shares needed for operational efficiency.

Are the shares held with your broker partner for Operational Efficiency termed as 'non-investor shares'?

We are not familiar with the term ‘non-investor’. It is not a term used by transfer agents.

Shares held at our broker are maintained in an account in the name of Computershare.

Registered and beneficial shareholders

What is a registered shareholder?

Registered shareholders, also known as "shareholders of record," are people or entities that hold shares directly in their own name on the company register. The issuer (or more usually, its transfer agent, such as Computershare) keeps the records of ownership for the registered shareholders and provides services such as transferring shares, paying dividends, coordinating shareholder communications and more. Shares can be held in both electronic form (book entry) through the Direct Registration System (DRS) or certificated form (when permitted by the issuer company).

What are the benefits of being a registered shareholder?

Ownership is recorded in your name directly on the register of the issuer. You are legally recognized as the registered owner of the shares. Computershare, as agent for the issuer, gives registered shareholders access to their holdings through our online Investor Center platform. Registered shareholders receive a proxy and can cast their vote directly at the issuer's shareholder meetings. The issuer has real-time visibility of shareowners and can efficiently communicate with them. Other common registered shareholder rights include the right to transfer ownership of their shares to others, to directly receive share dividends and also to inspect certain corporate documents.

What is a beneficial shareholder?

Beneficial shareholders have their stock held by an intermediary such as a broker. When shares are kept in this manner, it is often referred to as keeping the shares in "street name."

Many investors choose to be beneficial owners. They access their investments, account balances and other information through their broker/intermediary's online platform. All beneficial shares are generally held in electronic (book entry) form through the Depository Trust Company (DTC). In certain circumstances, shares may be 'lent' by the brokerage firm to cover other trading activity, such as short sells by others. The issuer has very little visibility of beneficial investors whose shares are held in "street name", and communications from the issuer are routed through the broker, usually by an agent acting for the broker.

Investor Center

Can I buy and sell shares through Computershare/Investor Center?

Yes, you can buy and sell shares through Computershare, but Computershare does not maintain a purchase and/or sales facility for all issuers. Computershare charges a nominal fee for these services.

Are all companies listed in Investor Center?

Only companies for whom Computershare is the transfer agent/registrar are found on Investor Center. However, you can manually enter investments in other companies for reference but details such as share price will not automatically update and you cannot use Investor Center to buy or sell such shares.

What information do I need to provide to register at Computershare Investor Center?

You will need either your Social Security Number (SSN) or Holder Account Number and the name of the company in which you are a shareholder.

Click here to register your account on Investor Center.

Do I need to use Investor Center to have my shares registered in DRS form?

No. You can have shares on the company's register without signing up for Investor Center.

How do you allocate account numbers?

We use a proprietary algorithm across all our clients, so numbers are not company specific.

Is it possible to access a shareholder’s Investor Center account and view their balance and recent transactions just using an account number?

No. An account number alone is not enough information to request changes or transact on a Computershare Investor Center account.

Is it possible to consolidate or merge two accounts when there are different beneficiaries named for transfer on death?

No. It's not possible to consolidate or merge two accounts with the same registration name if there are different beneficiaries named for transfer on death (TOD). However, the accounts can be merged if the same beneficiary is (or beneficiaries are) named on both accounts (or if no beneficiaries are named) and the allocation of the distributions to each beneficiary is also the same on both accounts.

Transferring shares/stock from your broker to DRS

How do I transfer my shares/stock from my broker into DRS form at Computershare if I live outside the US and my shares are held by a non-US broker?

Contact your broker. Your broker may use a custodian in DTC to hold shares in DTC. Only DTC participants can initiate a transfer to create a DRS holding in your name at Computershare, if the shares are held via DTC (please see above). Processes may vary depending on your jurisdiction.

How long does it take to transfer shares from beneficial to registered ownership?

We can't usually tell how much time has passed between a shareholder's request to transfer shares to registered ownership and the request being passed to us by the intermediary but, once we receive it, we should process it fully by the end of the next working day.

Are you notified when a shareholder asks an intermediary to transfer shares to registered ownership through Computershare?

No. Computershare does not receive any information about a request to transfer shares to DRS. We are only notified when the transfer is initiated by a DTC participant. A DTC participant may be your US broker, a clearing firm acting for your US broker, or a custodian acting for your international broker or another intermediary (e.g. an international central securities depositary) who, in turn, is acting for your international broker. We have no visibility of where your instruction sits in the chain.

Do you route share orders directly to the exchanges?

Yes. We instruct our broker to execute all orders on an applicable exchange, for example, the New York Stock Exchange. We do not receive ‘payment for order flow’.

Can you tell me if a particular broker is currently transferring shares to registered ownership through Computershare?

We do not publish a list. Please ask individual brokers directly about the services they offer. We're able to process any valid transfer initiated by a DTCC participant to transfer shares to registered ownership, and we usually complete the transaction by the end of the next working day, following receipt of that request from DTCC.

My broker is reporting a problem with the transfer of my shares to direct ownership. What’s happening?

Your broker may use a custodian in DTC to hold shares in DTC. Only DTC participants can initiate a transfer to create a DRS holding in your name at Computershare, if the shares are held via DTC (please see above). Processes may vary depending on your jurisdiction and the number of intermediaries in the chain. Computershare is able to process any request for a transfer of shares to registered ownership that includes the necessary information for the transfer to take place, and we usually complete the transaction the working day after the request comes through. You do not need an account with Computershare for a DRS transfer to be initiated.

Why doesn’t Computershare work with certain brokers/Why can’t my non-US broker get my shares registered?

We accept DRS transfer requests from DTC participants, as the DRS system is facilitated through DTC. If your broker is not a DTC participant, your broker should discuss how to give effect to a DRS transfer (on your behalf) by working with its clearing firm or custodian in DTC, or other intermediary that in turn may have a commercial custody or clearing arrangement with a DTC participant.

Whom would you notify if you had to reject a DRS transfer because there were not enough shares?

In the unusual event we needed to reject a DRS transfer owing to insufficient shares in the name of Cede & Co (as transferor), we anticipate we would let our issuer client, DTCC, the broker and the investor know.

Are you experiencing delays with processing shareholder registrations? Is there a backlog?

No. We have not experienced delays in processing new shareholder registrations in DRS form. We generally complete all requests to transfer from “street name” to registered form by the end of the next working day after receipt (well within regulated timeframes), provided such request is in good order. Please note that we have no knowledge or visibility of the point at which a beneficial owner asks their intermediary to initiate the transfer of their position from ‘street name’ to a registered shareholding and the relevant DTC participant initiating a DRS transfer via DTC with the required information.

How will tax apply to my transfer?

We can't give advice on tax or retirement accounts, and you should discuss this with your financial advisor. If you have a question about your specific account with Computershare, please contact us on +1 (201) 680 6578 or 800 522 6645.

I’m outside of the US. Is there a number I can ring to discuss my GameStop shareholding?

As well as calling our US Contact Center directly, we have set up a dedicated number to field GameStop enquiries: + 800 3823 3823. This is free to phone from a landline in the following countries…

International shareholders

Can I register for Investor Center to manage shares in a US-listed company if I live outside the US?

Yes. You can register to use our US Investor Center if you are not a US resident. We will use details relevant to your jurisdiction to confirm your identity.

Can I trade shares via Investor Center if I live outside the US?

Yes. Please be aware that, although this should be straightforward via Investor Center, transferring 'off market' may require a paper-based transfer form and a 'medallion guarantee' to be authorized. Shareholders are responsible for ensuring compliance with local laws where they reside.

Do you pay international payments in currencies other than US dollars?

Optionally, an international payment can be made in foreign currency (e.g. Euro, GBP or AUD).

How do I transfer shares to someone outside of the US?

You can use Transfer Wizard at https://www-us.computershare.com/TransferWizard/default.aspx?ReturnUrl=%2ftransferwizard. You can find an FAQ on Transfer Wizard at https://www-us.computershare.com/TransferWizard/FAQs.aspx.

What fees will I have to pay to my non-US broker to transfer my shares to registered ownership through Computershare?

You need to discuss this with your broker, who in turn may need to work with its custodian in DTC.

How does registered shareholding relate to Individual Savings Accounts (ISAs) in the UK?

We can't give advice on tax or ISAs, and you should discuss this with your financial advisor. If you have a question about your specific account with Computershare, please contact us on +1 (201) 680 6578 or 800 522 6645.

Questions about your shares in DRS at Computershare

Can Computershare ‘lend’ shares that are registered in my name?

No. This is not an authorized function of a transfer agent for shares held in registered form.

How can I keep track of the shares/stock I buy/sell?

The shares/stock you own, buy or sell in companies for whom Computershare is transfer agent/registrar can be monitored and accessed through your Investor Center account.

Are shares held through Computershare/Investor Center registered ownership shares or beneficially owned shares?

Yes, shares managed directly through our Investor Center are maintained on the register in the shareholder's name.

How does Computershare ensure there is a balance between shares that are registered/beneficially held?

We use double-entry accounting systems that ensure there is always an accurate balance between registered shares and those held by Cede & Co on behalf of DTC, banks & brokers and beneficial investors. This means that for every share transferred through DRS that can be registered on the share register, there is one fewer recorded as being in Cede & Co.

If an investor moves their shares to DRS via Computershare, is their account insured (for example through FDIC) if Computershare became insolvent?

No. Registered shareholders do not need SIPC insurance to underpin Computershare’s transfer agent function or protect against any insolvency of Computershare, since their shares are recorded on the company’s register, and held directly by them subject to relevant corporate law and regulation. Unlike a broker-dealer (where SIPC insurance may apply), Computershare does not hold the shares as an intermediary on the shareholder’s behalf. Computershare does not lend securities.

Does Computershare lend out shares held in registered form?

No. Computershare does not lend out registered shares as these shares are owned by the registered holder. For operational efficiency, a small portion of the aggregate number of DSPP shares is held on Computershare’s behalf (for the benefit of plan participants) by arrangement with our broker. These particular shares are maintained by the broker (for the benefit of Computershare, and in turn, for the benefit of plan participants) in DTC. Our broker is not permitted to lend out any of these shares.

Can registered shares be loaned to or otherwise accessed by the DTCC, the DTC or any other entity?

DTCC/DTC and Cede & Co cannot borrow shares from other registered shareholders. Computershare does not lend securities. Registered shares can be accessed by intermediaries where they are authorized to do so by the investor to sell or transfer them. This is evidenced to the Transfer Agent by the broker or bank transmitting the investor’s name and address, number of shares to be transferred and the investor’s unique holder identification number. This information is transmitted by the broker or bank through DTC to the Transfer Agent using the DRS Profile System. DTC’s FAST System governs the arrangement for managing Cede & Co’s dematerialized balance of shares on the register. Cede & Co.’s holding increases as deposits into DTC are made by banks and brokers and decreases as withdrawals are made by those parties for investors. Please see the video above illustrating these processes for more information.

What is the maximum limit order possible through your systems?

As of February 28, 2023, the maximum limit price you can set is dynamically capped at 600% above the current market price (the equivalent of seven times the current price) of the particular securities. For example, if you want to sell and the current market price of the share is $10 per share, the maximum limit price you can set at that time is $70 per share. The limit order price cap is dynamic and changes with fluctuations in share prices. Thus, if the market price increases to $12, the maximum limit order price will increase to $84.

What is a limit order?

A limit order is a specific instruction that an investor provides to Computershare to confirm the minimum price at which they request that their shares be sold.

A limit order differs fundamentally from a market order. A market order is an instruction to buy or sell a stock at the prevailing market price at that particular time, without any pre-set limit on the price.

Can I sell shares through Computershare?

Yes. Through Investor Center, you can sell shares in companies for whom Computershare is the transfer agent and for whom Computershare administers a plan or operates a DRS Sales Facility.

Do I need to buy shares through a broker and then transfer them to Computershare, or can I buy shares through Computershare directly?

You can buy shares/stock in companies for whom Computershare is the transfer agent/registrar and for whom Computershare administers a plan directly through Investor Center once you have signed up for an account. Computershare charges fees for these services.

Are DRS shares ‘locked up’ on Computershare’s systems?

No. Shares in DRS form can be sold and purchased via the US public markets and can only be transferred by the investor or his or her broker with permission.

Can I get my dividend in NFT form?

A dividend would only be paid in NFT form if the issuer decided that this is the format they would like to use.

Where can I find more information about selling shares through Computershare?

You can find out more information at https://www-us.computershare.com/Investor/#Help?lang=en&cc=US

What happens to my registered shareholding if Computershare is no longer the transfer agent?

In the context of registered shareholdings, Computershare as transfer agent is acting as a recordkeeper. Transfer agents do not have ownership of the securities for which they maintain the records of in any circumstances. Your registered shareholdings will be recorded and maintained by the issuer’s successor transfer agent.

Do you hold SIPC insurance (or any other insurance to protect shareholders)?

SIPC is not relevant in the context of transfer agents, as investors' assets are on the register, and the register would be taken on by a successor agent in the event Computershare were to ever become insolvent. Computershare carries professional indemnity insurance as cover for other issues.

How reliable are the data provided by Computershare to its clients?

Share registers and the shareholding position data we provide to issuer clients are reliable and accurate. The reported data reconciles with the issuer’s share capital. Information is available to issuers online generally on a 24/7 basis unless otherwise advised (e.g. for maintenance).

The accuracy of Computershare’s record-keeping is subject to regular audits by regulators.

Shareholder communications

Why do you send information through the post rather than using email or phone?

To improve information security and help prevent fraud, Computershare sends certain information to shareholders through the post. However, if you are a shareholder in GameStop and you are based in Europe, Computershare will mail ‘pin packs’ — which contain the verification code that enables access to Investor Center — to you from our facility in the UK, meaning they should arrive within one to two weeks. We are also looking at other ways to ensure communications can reach non-US shareholders sooner.

What are the benefits of switching to digital shareholder communications?

- E-comms means the company in which you own shares can communicate with you more easily, quickly and cost effectively

- E-comms can be a more reliable method of ensuring you receive the information you need

- E-comms mean you can immediately gain receipt of proxy material, annual reports, notices of meetings and other materials

- E-comms enable you to vote your proxy online for the proposals put forth to shareholders rather than having to return your vote through the mail

- E-comms mean less paper, printing and transport, which reduces carbon emissions, uses fewer resources and means a more positive impact on our planet

- With more and more shareholders, managers and directors focusing on a corporation’s environmental, social and governance (ESG) initiatives, e-comms can help align a company’s practices with its sustainability goals

How to I enroll in digital shareholder communications?

If you have an Investor Center account:

- Log in at www.computershare.com/investor

- Click on 'View and update your profile'

- Click on 'Communication Preferences' and then 'Account Communication Preferences'

- You will see a list of your shareholdings

- For the shareholding for which you would like to register for e-comms, click 'Edit'

- Enter the email address you would like e-comms notifications to go to (or select 'Use same email as Investor Centre Membership'

- Select 'Email' for each of the types of material you would like to receive notification about via email

- Review the Terms and Conditions (which you can find by clicking on Terms and Conditions)

- Select 'I agree to the Terms and Conditions'

- Click submit

- You should now see a message confirming that the update to your communications preferences has been successful

- You can follow these steps to set your delivery preferences for other securities you hold for which you would like to receive e-comms

How does digital shareholder communications work?

Once you set your preferences to receive digital communications, you’ll receive email notifications when new material, such as an annual reports, proxy voting forms, and statements are available to view online. Your email notification will be accompanied with a link to a page on Investor Center, where you can securely log in and view the available communications and documents.

How can I enroll in text messaging?

US shareholders in US companies can also enroll in text messaging to receive notifications, alerts and select other account transactions via text message. Shareholders must have a US mobile number and a phone that can receive SMS/text messages.

If you have an Investor Center account:

- Log in at www.computershare.com/investor

- Click on ‘View and update your profile’

- Click on ‘Text Communications’

- You will see a field to enter your 10-digit U.S. mobile number

- Enter the 10-digit U.S. mobile number you would like text messages sent to

- Click the box next to the terms of consent

- Click submit

You should now see a confirmation that your request to update text communications is being processed and receive a welcome text message from Computershare.

Can I still receive hard copy materials if I’ve enrolled for ecomms?

In the event that your email communication ‘bounces’ we will send a hard copy pack to you. You can also request a hardcopy. However, this does negate the benefits of having switched to ecomms, so we suggest shareholders only do this in exceptional circumstances. Our ability to send additional hard copies is subject to availability.

Individual Retirement Account (IRA)

How does registered shareholding work in relation to an individual retirement account (IRA)? Can people register their IRA shares?

We don’t believe there is any reason why shares can’t be transferred from an IRA into a person's name on the register in DRS format, but there may be unfavorable tax consequences. People should speak to their plan sponsor about whether it’s possible and of course seek financial and tax advice before making any decisions. If you have a question about your specific account please contact us on +1 (201) 680 6578 or 800 522 6645.

Does Computershare act as a custodian for shares in an individual retirement account (IRA)?

No. As a transfer agent Computershare does not provide IRA services, and we have to reject or reverse any transfer that purports to register shares into an IRA account where Computershare is noted as the IRA custodian for the particular investor.

Direct stock purchase plan (DSPP)

What is a direct stock purchase plan?

Direct stock purchase plans are an alternative way to buy the shares of certain companies. Benefits of direct stock purchase plans include the ability to set up automatic, periodic investments and automatic reinvestment of earned dividends. Individual companies set up direct purchase plans to allow investors, in some cases, to buy shares of stock directly from the company. The Company's transfer agent will effect trades through a trading broker and allocate shares to their registered accounts on the records of the company. For plan-specific information, including fees, shareholders should refer to relevant plan documents.

How are shares held via the direct registration system (DRS) and those held in book-entry via a direct stock purchase plan (DSPP) different?

- DSPP and ‘pure’ DRS shares are technically different forms of holding although, for many practical purposes, they are the same

- Both forms of ownership record the names of the investor directly on the issuer’s register, where they are recognized as registered shareholders

- In both cases, the investors are sent communications by the company and can directly vote their shares

- Both forms of ownership are recorded directly on Computershare’s platform and may be managed by the shareholder through the online portal, Investor Center

- Both DSPP & DRS are ‘book entry’ means of holding shares

- DRS shares do not require enrollment into a ‘plan’ nor is there a need to make elections around dividend payment allocations

- DSPPs are specific plans that require shareholders to elect enrollment

- DSPP shares allow for the shareholder to elect for dividend payment to be allocated as to their discretion, including to reinvest into the purchase of additional shares.

- Dividends are paid, and proxy voting instructions are issued, on a consolidated basis i.e. for the aggregate of DRS and DSPP book-entry positions. Computershare does not issue separate proxies or make two dividend payments

- An investor can, at any time, withdraw all or part of their shares in DSPP book-entry form and have them added to their DRS holding (for example after a DSPP purchase settles) without a fee

- Shares held in DRS form and DSPP book-entry form (with the exception of any fractional amount) can be transferred in a single parcel to a broker or in multiple parcels to multiple brokers at any time via the DRS system

- Shares held in DRS and DSPP book-entry form can be sold via Computershare, subject to the terms and conditions of the DRS Sales Facility or DSPP, as applicable.

If investors elect to reinvest dividends through a Direct Stock Purchase Plan (DSPP) administered by Computershare for one of their shareholdings, does that election apply to all shares held by investors for that specific issuer?

Yes, unless the relevant issuer offers a partial election option for any of its Dividend Reinvestment Plan arrangements. Most issuers do not offer a partial election option. When a partial election is available, shareholders must specify the level of participation by indicating the number or percentage of shares for which they would like to reinvest their dividends.

If all shares qualify for the DRIP, does that mean all of those shares (i.e. those in DRS and DSPP) are eligible for share lending?

No. None of the shares maintained on shareholder records at Computershare are eligible for share lending. This includes all shares held in DRS or DSPP-related holdings.

Can fractional shares be held outside a direct stock purchase plan (DSPP)?

No. Fractional shares cannot be held outside a DSPP, nor can they be moved to a broker or another intermediary. DRS and certificated holding types do not allow for fractional share ownership

When an investor withdraws all or part of their shares in DSPP book-entry form and has them added to their DRS holding (for example after a DSPP purchase settles), any remaining fractional shares will be handled as set forth in the DSPP terms and conditions. However, there is no requirement to sell fractional shares when transferring any whole shares. The fractional shares may remain in the plan for as long as the investor chooses, subject to any specific conditions in the plan which may preclude the ownership of only fractional shares.

Are there differences between shares that are held directly and those that are held in a direct stock purchase plan (DSPP) are reported?

They are mostly the same for all practical purposes. However, there are some minor differences:

- Both forms of ownership are recorded directly on Computershare’s platform and may be managed by the investor through Investor Center

- It is not possible to hold fractional entitlements to registered shares in DRS form, only whole shares. It is possible, however, to hold fractional entitlements to shares in book-entry form through the DSPP

- Dividends are paid, and proxy voting instructions are issued, on a consolidated basis, i.e. for the aggregate of DRS and DSPP book-entry positions. We do not issue separate proxies or make two dividend payments.

- Shares held in DRS form and DSPP book-entry form can be sold via Computershare, subject to the terms and conditions of the DRS Sales Facility or DSPP, as applicable

- Computershare holds a portion of the aggregate DSPP book-entry shares via its broker in DTC for operational efficiency, i.e. to enable any sales to be settled efficiently (and Computershare determines the portion needed for operational efficiency reasons. Such shares are not available for lending. These shares are eligible to be withdrawn from DTC).

- An investor can, at any time, withdraw all or part of their shares in DSPP book-entry form and have them added to their DRS holding. The investor is able to transfer whole shares from DSPP book-entry to DRS at any time, e.g. after any DSPP purchase settles. Any remaining fractional shares will be handled as set forth in the DSPP terms and conditions.

Are shares held in a DSPP not included in the tally of registered shares?

Computershare provides its issuer clients with separate tallies for DRS and DSPP shareholdings

It is up to individual companies what information on shareholdings they disclose to investors or the general public and in what format (within the confines of relevant legislation and regulation)

A group of investors recently asked the SEC to clarify whether any investors’ DSPP shares are held in DTC. The SEC published something on this in their recent bulletin. Can you tell us whether the SEC’s bulletin accurately describes the structure and workings of GameStop’s DSPP at Computershare?

Mostly, yes. However, we’d probably describe things a little differently.

As previously shared in our FAQ and other videos, we maintain a portion of shares underpinning the plan via our broker in DTC. Typically, we hold between 10 and 20% of the shares underpinning the plan with a broker.

DSPP shares are registered in the investor’s name and held as a sub-class or sub-ledger on the books of the issuer.

The overall count (or total number) of plan shares always equals the number of shares held by investors enrolled in the plan regardless of the portion of shares Computershare holds on the register and separately through its broker in DTC.

We do a daily reconciliation of the total number of shares held at the broker (in Computershare’s name) and the Computershare nominee that holds the balance of shares, typically 80%-90% on the register, to the total number of shares in the sub-ledger.

How exactly does enrolling in the DirectStock Plan affect the title and classification of Pure DRS shares within an investor’s account? Are DRS shares considered to ‘underpin’ the plan upon actions such as purchase, DRIP enrollment, or setting a limit sell order, and does this reclassification apply universally across all shares in the account or other Investor Center accounts controlled by the same individual?

How a registered shareholder holds their shares in a company does not change according to participation in the company investment plan (aka DSPP, DRP, DirectStock, CIP).

Shares purchased using voluntary cash (one-time or recurring) and any dividend reinvestment of shares will always be held in the plan. This does not affect how other shares are held and maintained. For instance, DRS, Certificated and Plan shares are held in the shareholder’s name on the register.

Each type of holding (DRS, Certificated, Plan) is reflected separately in a shareholder account. A shareholder list reported to the company or the regulators reflects the total number of shares of the same class of stock held by each registered shareholder.

Can you outline the chains of custody and ownership for Pure DRS and DSPP shares enrolled in the DirectStock Plan? Please specify how names are recorded 'On the Ledger' in different holding scenarios.

The first part is a very straightforward answer. There is no ‘chain of custody’ for DRS or Pure DRS. Investors hold the shares in their own name. There is no intermediary. Computershare’s role here is solely as a transfer agent (i.e., the agent of the issuer).

For the DSPP, we use a Computershare nominee to hold the underlying shares. For the largest portion of the plan holding (80%-90%), these shares are held on the register in the main class. So the chain of custody is “CPU Nominee -> Investor”.

For the 10%-20% that we hold via our broker at DTC, the custody chain is “Cede -> Broker -> Computershare -> investor”. Notwithstanding this, all holding types are registered and held in the name of the investor in the sub-class.

Are shares bought on the open market through the DirectStock Plan categorized as 'DTC Stock Withdrawals (DRS)', such as shares transferred from a brokerage to a Computershare account?

No. Computershare sponsors the DirectStock Plan, which is an open-market purchase plan. Trades for the DirectStock Plan are settled on the Computershare brokerage account. Post-trade shares are moved back to the nominee on the Computershare register. For operational efficiency, it is sufficient to leave 10%-20% of the shares in DTC.

Issuer-sponsored plans and non-issuer sponsored plans, such as Computershare’s DirectStock, are distinct structures. Would you agree with the summary that DSPs make shares available from the issuer directly and plan details are filed with the SEC, and DSPPs allow for share access through the open market via a Transfer Agent and plan details are not filed with the SEC?

Those statements are correct. Issuer-sponsored registered plans are filed with the SEC. Shares may be made available by the issuer, or the plan can provide for open market purchases. Bank-sponsored direct stock purchase plans operate under an SEC exception, and they purchase shares exclusively in the open market.

Who holds title for the DSPP shares held at the DTC for Operational Efficiency, and how is this entity reflected 'On the Ledger'?

Computershare holds the title for the benefit of the underlying plan participants. Computershare holds a position with its broker. The broker has an account at DTC. DTC holds shares on the register through Cede & Co. On the ledger, the title for this specific portion of the shares falls within the Cede & Co holding.

Computershare has indicated in the FAQ that issuers can choose to disclose shares in DSPP in their tally of registered shares and that such a disclosure may be subject to relevant legislation and regulation. Could you or Computershare’s legal team provide examples of relevant legislation and regulation?

This is a question that should be posed to your financial advisor or your attorney.

Computershare cannot provide legal advice on issuer-specific legal requirements under applicable securities or other laws; however, one example would be SEC reporting requirements.

Are there any restrictions or compliance requirements that company insiders should be aware of when registering their shares with Computershare? Does the process for corporate insiders mirror that of retail investors, or are there distinct procedures or considerations that apply?

Computershare takes instruction from its issuer clients with respect to any restrictions on shares. How company employees choose to hold their shares is up to them. We don’t comment on how particular investors choose to hold their shares, nor do we provide advice. We also cannot comment on issuers’ policies with respect to their insiders.

This question relates to registered shares rather than plans. Please note that affiliates cannot participate in plans.

Are certificates enrolled in the DirectStock plan considered part of the aggregate DSPP shares?

Certificated shares can be enrolled in the plan. It does not change the certificated position. However, certificated shares (like DRS shares) are not part of the aggregate DSPP shares.

Paper certificates can be enrolled in DirectStock plan, however, they are marked “not available” in the investor center. If not, can you explain why, and how that relationship works?

Certificated shares are marked ‘not available’ as the shares represented by the certificate are not included within the DSPP plan. This remains the case until the certificate is deposited with Computershare to enable those shares to be held in ‘book entry’ form. Shares represented by certificates may be enrolled in the dividend reinvestment feature (DRP) of the plan, if available. Any new shares issued as a result of such a DRP election will be issued in ‘book entry’ form within the plan, regardless of whether the underlying shares remain in certificated form or book entry (because the certificate was deposited).

Do any parties ‘borrow’ shares from Computershare, specifically using shares in a DSPP?

No. We don’t make securities available for lending either on the register or through DSPP shares held through our broker. We have written confirmation from our broker on the latter.

About Computershare

What is a transfer agent (such as Computershare)?

Transfer agents (referred to as the 'registrar' in some jurisdictions) maintain a record of ownership, including contact information, of an issuer's registered shareholders. Brokers maintain the records of beneficial shareholders. Transfer agents' responsibilities also include the transfer, issuance and cancellation of an issuer's shares. One of a transfer agent's primary duties is assisting registered shareholders and fulfilling their requests for transferring their shares.

Other core services provided by a transfer agent include issuing dividend payments and communication with shareholders on behalf of the issuer.

Transfer agents also ensure that companies do not issue more shares of stock than has been authorized.

Why is Computershare trading on the over-the-counter market? Being a global company, why isn’t Computershare listed in every country it operates in?

Computershare is a publicly-listed company on the Australian Stock Exchange (ASX) and our shares trade in Australian dollars with the ticker symbol CPU. You can find details by entering "CPU.AX stock quote" into your search platform, or by visiting our website www.computershare.com. Computershare is not listed in the US. However, some parties choose to trade the shares in US dollars in the "unlisted" US OTC market.

What fees does Computershare charge shareholders/how does Computershare make money from share ownership?

Companies hire Computershare to undertake transfer agent/registry services on their behalf, which includes providing services to their registered shareholders directly. Although some of these services are free to registered shareholders, such as maintaining the record of a shareholding through Investor Center, we do charge shareholders themselves when they ask us to process specific transactions, including buying and selling shares. You can find out more information on these charges here.

How can you tell if someone claiming to be posting on social media on behalf of Computershare is legitimate or not?

Our employees do not post 'on behalf' of Computershare on their individual accounts on social media. While many employees are active on social media, and some chose to identify themselves as Computershare employees, they do so as individuals, not as official representatives. Computershare engages in social media via its official accounts, including Twitter and LinkedIn, which are easily verifiable. Computershare spokespeople also undertake interviews, with the content sometimes featuring on social media. Whenever they do so, they will be clearly identifiable as Computershare representatives, including by providing their name and job title. We would recommend discounting anyone claiming anonymously to represent or be an employee of Computershare.

What brokerage firm does Computershare use to execute orders?

The brokerage firm we work with can depend on the circumstances of the order, including to enable us to accommodate the preferences of specific clients. In most instances, however, we work with Bank of America Merrill Lynch (also known as Merrill).

Questions about specific company information

Where can I find information about a specific company?

You can view all the information we provide on specific companies at https://www-us.computershare.com/Investor/#Company.

What proportion of GME DSPP is held at DTC?

Yes. In its 10-Q filing (September 10, 2025), Gamestop reported that “approximately 0.1 million of the shares in the DSPP were held at DTC in nominee form by Computershare, with all other registered shares being recorded directly by Computershare as of September 5, 2025.” For more information, please see Gamestop Corp. (GME) 10-Q Quarterly Report September 2025.

How did Computershare process the GameStop ‘stock split’ in July 2022?

GameStop effected a 4 for 1 ‘stock split’ through a 3 for 1 stock dividend, whereby on July 21, 2022 three additional shares were issued for every share held at record date, giving each shareholder a balance of four times the number of shares. Trading in the ‘split’ shares started on July 22. Computershare issued statements showing the 3 for 1 stock dividend distribution, giving the holder a balance of four times the number of pre-‘split’ shares to reflect this.

I’m a beneficial shareholder and have not received shares from the GameStop ‘stock split’ in July 2022. What should I do?

Investors who hold their GameStop shares in beneficial form via a broker should contact their broker if they have not received shares due to them from the GameStop ‘stock split’ of July 2022.

What proportion of GME DSPP is held at DTC?

Yes. In its 10-Q filing (September 10, 2025), Gamestop reported that “approximately 0.1 million of the shares in the DSPP were held at DTC in nominee form by Computershare, with all other registered shares being recorded directly by Computershare as of September 5, 2025.” For more information, please see Gamestop Corp. (GME) 10-Q Quarterly Report September 2025.

Questions about GameStop warrants

What is Computershare's role in GameStop's warrants?

As the warrant agent for GameStop, Computershare administers the warrants in accordance with the terms of the warrant agreement. We maintain the records of warrant holders and process warrant exercises, transfers, and sales.

The most important source of information on warrants is the FAQs that GameStop has published, which covers a wide range of information, including what warrants and warrant dividends are, who will receive them, and other details such as volume, relevant dates and prices.

You can find the GameStop Shareholder FAQ on Warrant Dividend Distribution here.

Where can shareholders see the record of their warrant entitlements?

Holders are able to view their warrant entitlements on their Investor Center account or the Computershare corporate actions web portal for GameStop. However, if shareholders want to exercise their warrants, they must do so before they expire on October 30, 2026.

What can holders do with their warrants?

Warrant holders are able to transfer, trade or exercise their warrants – or none of the above in which case the warrants will lapse at expiry.

If holders want to exercise their warrants, they must do so before they expire on October 30, 2026.

Warrant holders should seek their own financial advice to determine the best course of action for their personal circumstances.

If shareholders hold their shares in the Direct Registration System (DRS) through Computershare, how do they exercise their GameStop warrants?

Holders are able to exercise their GameStop warrants through a dedicated Computershare web portal. On or about October 7, 2025, we sent a communication to GameStop shareholders (using their preferred method) to inform them that the warrants are now available.

We received an email from Computershare about the warrants. How do we know it's legitimate?

We can confirm the ‘noreply@computersharecas.com' email address is a legitimate email from Computershare. However, if you should have any doubts, you can also go directly to the Computershare corporate actions web portal for GameStop to take action.

How do shareholders sell their warrant(s) if they're in DRS at Computershare?

Shareholders can go to a dedicated Computershare web portal to sell their warrants.

How do beneficial shareholders exercise their GameStop warrants?

They'll need to contact their bank or broker for this information.

How is DTCC involved when shareholders' warrants are exercised?

DTCC services banks or brokers acting on their own behalf or for beneficial shareholders. DTCC provides application details to Computershare as the warrant agent. Computershare will then issue shares back to DTCC. This has no impact on registered shareholders.

What if shareholders don't exercise their warrants by the expiration date?

Warrants are time sensitive. Once the expiration date has passed, the warrant lapses and the warrant holder no longer has the right to buy new shares at the pre-determined price.

What fees will shareholders be charged for transferring warrant(s) to their broker?

Computershare does not charge holders for transferring warrants to a broker. However, beneficial shareholders should check whether the broker may charge them a fee.

Is it true that once the warrants are exercised, the ‘new' shares are moved into a direct stock purchase plan?

GameStop shareholders who exercise their warrants will receive the ‘new' shares as DRS.

Depository Trust Company (DTC)

What is the Depository Trust Company (DTC)?

The Depository Trust Company (DTC) is a repository through which stocks are transferred electronically between brokers and agents. It provides electronic recordkeeping and clearinghouse services. The DTC was established to reduce the volume of physical stock certificate transfers involved in the trading of securities. It holds eligible securities for financial institutions such as brokerage firms and banks, collectively referred to as "participants." Transfer agents are "limited participants". Participants then may request debits and corresponding credits to their DTC accounts to effect transfers. In this manner the DTC facilitates share transfers on behalf of shareholders via their brokers or transfer agents. The DTC is part of the Depository Trust & Clearing Corporation (DTCC). DTC uses a nominee, Cede & Co, to hold securities on the register.

Are all DSP/plan shares or Direct Stock shares on the sub-ledger in the DTC Computershare account rather than being in a user account? Yes or no?

The simple answer is no. However, there are two elements to the question here. The answer to the first part is ‘no’.

The answer to the second point is that a portion of the shares, typically between 10% and 20%, of the plan are held at our broker.

We've addressed this question before, and the answer can be found in the DSP section of the FAQ

Does Computershare, its subsidiaries, nominees, or broker-dealers receive compensation from the DTC, issuers, or any other third parties for maintaining Operational Efficiency?

No.

As stated in the FAQ, all shares (both book and plan) are registered shares. Are any portion of any of those shares beneficially owned?

If Computershare holds any portion of the Plan shares in a brokerage account through DTC, then that portion of shares will be beneficially owned by the investors. However, all holdings, including full plan shareholdings, are recorded on the register (including the sub-ledger for plan shareholdings) and reported to the company, and all plan holders are treated as registered holders of the company.

Shares held at the broker maintained in an account in the name of Computershare. The FAQ states that Computershare determines the portion of shares held at DTC for operational efficiency - is that percentage of aggregate DSPP shares determined through market conditions such as daily volume or price, how often is it recalculated, and how can retail investors track what percentage of shares underpinning the plan of a given security are allotted for operational efficiency?

No, this feature has absolutely no relationship to market trading volumes or market conditions. Computershare determines the specific amount, and we can and do occasionally recalculate the percentage of shares split between the register and DTC.

We do not believe the issuer, transfer agent or plan administrator needs to disclose the portion of shares held in DTC via a broker; not even in light of the recent allegations or the so-called heat lamp theory. In our view the features of the plan are beneficial, not detrimental to investors. We have operated this way for well over a decade, and this has never been an issue from an issuer, a shareholder or a regulator perspective.

Some of Computershare’s online customer service representatives have stated that Dingo & Co was the nominee used for plan shares, but information online about Dingo & Co is sparse. Can you provide more information on Dingo & Co and its function, and how investors can find more information about Dingo & Co?

Dingo & Co is a nominee for Computershare as a transfer agent for its issuer clients. Computershare uses it for holding and transacting shares in connection with direct stock purchase and dividend reinvestment plans.

Dingo is used for operational purposes. As a nominee, Dingo & Co has no interest in and no rights to the property it holds in its name on behalf of Computershare. In other words, Dingo holds assets but does not own any of them.

While Dingo & Co holds plan shares on the registers of Computershare’s issuer clients, the owners are treated as the registered owners of the plan shares, which includes proxy voting rights and dividends.

Computershare maintains a sub-class or sub-ledger reflecting the owners of the shares. As we’ve noted before, investors are freely able to transfer whole shares between the plan and pure DRS. This instruction can be given electronically via the Investor Center, and there is no cost to the investor.

Regulatory

What rules govern share issuances in the US?

Stock issuances by companies are governed by the Securities Act of 1933 and the Securities Exchange Act of 1934, and regulations thereunder, which are enforced by the United States Securities and Exchange Commission (SEC). Issuers are also subject to the corporate law of the company's state of incorporation, the rules of the exchange on which its stock is traded, operational guidelines and eligibility requirements of The Depository Trust Company (DTC), if eligible, and the issuers' corporate bylaws, articles of incorporation and other corporate governing documents.

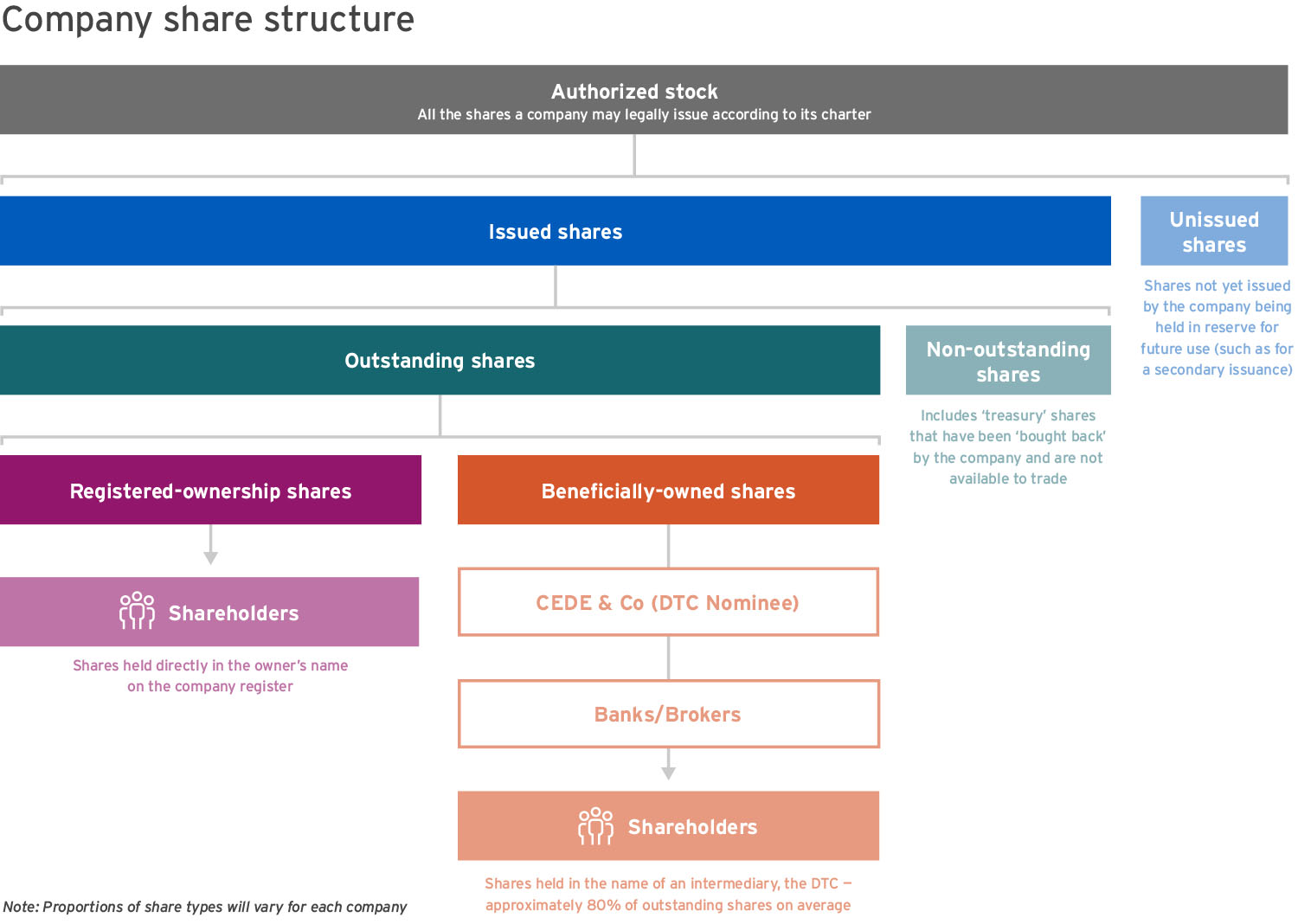

Corporations may issue different classes of stock, which may be subject to different ownership rules, value per share and privileges, such as the right to vote on certain corporate matters. For more information, please see the diagram above.

What rules govern how transfer agents operate?

Since the mid-1970s, transfer agents have been subject to federal regulation by the SEC in accordance with the Securities Exchange Act of 1934. Transfer agents must comply with all applicable rules of the SEC, primarily rules 17Ad-1 through 17Ad-20 of the Securities Exchange Act of 1934. These rules include strict requirements for the accuracy and timeliness of processing shareholder transactions. Given wide fluctuations in trading volume and shareholder inquiries, transfer agents must also be prepared to handle associated periods of peak transfer volume. Activities that are governed by these regulations include:

- Turnaround times for processing

- Prompt responses to inquiries

- Accuracy of recordkeeping

- Retention of records

- Posting, transportation and destruction of certificates

- Safeguarding of funds and securities

- Evaluation of internal accounting controls

- Searches for lost shareholders

- Notifications to "unresponsive payees"

Securities industry participants, such as transfer agents, must also comply with regulations designed to prevent fraud in connection with missing, lost, counterfeit or stolen securities, in addition to other data security requirements. These data security requirements also extend to industry participants' employees, who must be fingerprinted and undergo background checks. In addition, transfer agents are required to comply with certain provisions of the Anti-Money Laundering (AML) regulations and can also be subject to regulations of the Office of Foreign Assets Control (OFAC). Transfer agents may also be subject to the laws of the states of incorporation for both issuers and their shareholders by virtue of the services they provide, including laws pertaining to data privacy and escheatment. Transfer agents are additionally required by IRS regulations to track and report the dividend income and share sale activity they facilitate on behalf of issuers via Form 1099 reporting. Transfer agents must follow IRS requirements concerning tax.

Did Computershare receive instructions from Cede & Co. and the DTCC to limit the registered shares to only 25% for "Market Efficiency"?

No. That would have been inappropriate, then or at any time.

Other questions (misc)

What are ‘stockholder lists’ and ‘issuer ledgers’?

A ‘stockholder list’ is a list of the names and addresses of anyone that owns shares directly in the relevant company as of a particular date. It also lists the number of shares they hold. It may also be referred to as the ‘register.’ An ‘issuer ledger’ provides additional details on share ownership, including information regarding transfers and issuances.

How do issuers access or view their stockholder lists/ledgers/registers?

Most publicly-listed companies employ a transfer agent (sometimes referred to as a ‘registrar’ outside of the US) such as Computershare to manage their shareholder records. Transfer agents’ responsibilities include ensuring their clients can access and view their shareholder records at any time.

How can members of the public or shareholders of a company view a stockholder list/register?

Anyone wanting to view a stockholder list/register should contact the relevant issuing company, usually through its investor relations office. Issuers may provide access to the stockholder list (or ‘register’) based on relevant state and national laws and regulations, as well as their own corporate governance policies. These will differ between companies and jurisdictions.

Can you clarify why Mainstar Trust removed shares from DRS and their reason for doing so was "due to limitations from the transfer agent regarding communication, reporting, and reconciliation" - What type of communication, reporting, and reconciliation could they be talking about?

We cannot speak to the motives of another company.

Would there be any circumstances where account access or the ability to sell could be blocked?

Yes, but in rare instances. Stops can be placed on the account or holding, either in the interest of the shareholder or for legal or regulatory reasons. For example, account access may be limited if the account holder places a stop on their shareholding, an account security condition arises, the shareholder is deceased, there are unsettled transactions, or there is a legal or regulatory restriction on trading the security.

If there were a large event, is there priority given to certain users to clear vs others?

Based on the question, we believe that you are trying to understand if there was an overwhelming demand and a queue forms, what will happen. Hopefully, we have interpreted this correctly.

We treat all shareholders alike and take instructions on a ‘first come, first served’ basis. No shareholder is given priority over another.

Could you address investor concerns that the predictable schedule for DirectStock Plan open market purchases introduces arbitrage opportunities and creates worse outcomes for plan participants in terms of dollars invested/shares owned?

Based on our review as outlined below, the concern that the predictability of scheduled share purchases through the investment plan could lead to arbitrage opportunities or exploitation of pricing differences appears to be unfounded.

There are several factors that mitigate against the arbitrage opportunity and pricing exploitation including:

- The quantity of the shares is unknown to the public and varies greatly (e.g. 100 shares versus 100,000 shares).

- The presence of other market participants selling shares.

- Each order is often broken down into smaller parcels, and the size of individual trades is too small to move the market price.

We have reviewed several dates' worth of orders and trade executions and found no unusual or egregious price changes. We analyzed data based on the number of trades, the number of shares purchased, execution price, and market pricing before and after Computershare’s orders for DSPP shareholders were executed, and compared the execution price with the opening price, closing price, and volume-weighted average price (VWAP). This analysis suggests to us that there is no exploitation of orders executed via the investment plan.

Participation in the plan is entirely optional. Shareholders can discontinue participation in a Plan and move all their whole shares held in the Plan to DRS.

Did the terms and conditions change for Investor Center include additional language for limited liability? (added 6/2/25)

Computershare reviews and amends its terms and conditions (T&Cs) as part of its standard business operations. Recently updated T&Cs included revised limitation of liability language, including a declaration of the maximum aggregate liability of the provider for all damages or losses related to the Investor Center service. Such liability language is commonly found in the T&Cs of online services.

Please note that Investor Center is a web portal that acts as a point of access for shareholders. Shareholding records are maintained securely within our core record system. Investor Center is one method that shareholders of Computershare’s issuer clients can use to interact with their investments. They can also call our contact center via the number found on their account statement.

The new Computershare terms and conditions state that an account can be terminated anytime for any reason. Is that true?

The terms and conditions related to online access to accounts were recently updated primarily for modernization purposes. The termination referenced is for online access.

Plan terms and conditions have not been changed with respect to the termination of participation in the plan. If participation in the plan is terminated, full shares will move into DRS and fractional shares will be sold in accordance with the terms of the plan.

My limit order was cancelled. What happened?

It is the policy of our executing broker to reject sale orders when the limit price is more than 30% below the current market price*. For example, if the market price is $10 your sale order will be rejected if you set a limit price of $5, which is 50% below the current market price.

Note that limit orders placed after hours and existing ‘Good-‘til-Cancelled’ orders are subject to screening for the 30% threshold in pre-market before the US market opens each morning.

*National Best Bid (NBB) represents the highest displayed bid price available for a security across the various exchanges or liquidity providers.

What can I do if my limit order is cancelled?

We encourage shareholders to check the status of their executions on their accounts online. Shareholders can resubmit their orders or contact us for help.

Given the continued concern expressed by a small number of shareholders about one or two securities, is Computershare re-evaluating its overall operational efficiency process?

We periodically evaluate our processes in the normal course of business. Any decisions about amending operational efficiency processes in relation to specific securities and external considerations would always be made by Computershare in consultation with the relevant client.

Where can I get more help?

We recommend first looking for answers via our FAQs at https://www-us.computershare.com/Investor/#Help/FAQ/. If you can't find the information you're looking for, you can try our Live Chat. You can also email or phone us directly using the contact details here.

New Questions

Below, you'll find the latest questions that have been added to our FAQ about DRS. As we provide answers to these new questions, the older Q&A entries will be incorporated into the broader FAQ with an annotated date stamp. We hope this approach will assist shareholders in finding specific information.

What is Computershare’s role in GameStop’s warrants? (added 10/16/25)

As the warrant agent for GameStop, Computershare administers the warrants in accordance with the terms of the warrant agreement. We maintain the records of warrant holders and process warrant exercises, transfers, and sales.

The most important source of information on warrants is the FAQs that GameStop has published, which covers a wide range of information, including what warrants and warrant dividends are, who will receive them, and other details such as volume, relevant dates and prices.

You can find the GameStop Shareholder FAQ on Warrant Dividend Distribution here.

Where can shareholders see the record of their warrant entitlements? (added 10/16/25)

Holders are able to view their warrant entitlements on their Investor Center account or the Computershare corporate actions web portal for GameStop. However, if shareholders want to exercise their warrants, they must do so before they expire on October 30, 2026.

What can holders do with their warrants? (added 10/16/25)

Warrant holders are able to transfer, trade or exercise their warrants – or none of the above in which case the warrants will lapse at expiry.

If holders want to exercise their warrants, they must do so before they expire on October 30, 2026.

Warrant holders should seek their own financial advice to determine the best course of action for their personal circumstances.

If shareholders hold their shares in the Direct Registration System (DRS) through Computershare, how do they exercise their GameStop warrants? (added 10/16/25)

Holders are able to exercise their GameStop warrants through a dedicated Computershare web portal. On or about October 7, 2025, we sent a communication to GameStop shareholders (using their preferred method) to inform them that the warrants are now available.

We received an email from Computershare about the warrants. How do we know it’s legitimate? (added 10/16/25)

We can confirm the ‘noreply@computersharecas.com’ email address is a legitimate email from Computershare. However, if you should have any doubts, you can also go directly to the Computershare corporate actions web portal for GameStop to take action.

How do shareholders sell their warrant(s) if they’re in DRS at Computershare? (added 10/16/25)

Shareholders can go to a dedicated Computershare web portal to sell.

How do beneficial shareholders exercise their GameStop warrants? (added 10/16/25)

They’ll need to contact their bank or broker for this information.

How is DTCC involved when shareholders’ warrants are exercised? (added 10/16/25)

DTCC services banks or brokers acting on their own behalf or for beneficial shareholders. DTCC provides application details to Computershare as the warrant agent. Computershare will then issue shares back to DTCC. This has no impact on registered shareholders.

What if shareholders don’t exercise their warrants by the expiration date? (added 10/16/25)

Warrants are time sensitive. Once the expiration date has passed, the warrant lapses and the warrant holder no longer has the right to buy new shares at the pre-determined price.

What fees will shareholders be charged for transferring warrant(s) to their broker? (added 10/16/25)

Computershare does not charge holders for transferring warrants to a broker. However, beneficial shareholders should check whether the broker may charge them a fee.

Is it true that once the warrants are exercised, the ‘new’ shares are moved into a direct stock purchase plan? (added 10/16/25)

GameStop shareholders who exercise their warrants will receive the ‘new’ shares as DRS.

What proportion of GME DSPP is held at DTC? (added 9/19/25)

Yes. In its 10-Q filing (September 10, 2025), Gamestop reported that “approximately 0.1 million of the shares in the DSPP were held at DTC in nominee form by Computershare, with all other registered shares being recorded directly by Computershare as of September 5, 2025.” For more information, please see Gamestop Corp. (GME) 10-Q Quarterly Report September 2025.

Are certificates enrolled in the DirectStock plan considered part of the aggregate DSPP shares?(added 9/19/25)

Certificated shares can be enrolled in the plan. It does not change the certificated position. However, certificated shares (like DRS shares) are not part of the aggregate DSPP shares.

Paper certificates can be enrolled in DirectStock plan, however, they are marked “not available” in the investor center. If not, can you explain why, and how that relationship works? (added 9/19/25)

Certificated shares are marked ‘not available’ as the shares represented by the certificate are not included within the DSPP plan. This remains the case until the certificate is deposited with Computershare to enable those shares to be held in ‘book entry’ form. Shares represented by certificates may be enrolled in the dividend reinvestment feature (DRP) of the plan, if available. Any new shares issued as a result of such a DRP election will be issued in ‘book entry’ form within the plan, regardless of whether the underlying shares remain in certificated form or book entry (because the certificate was deposited).