Computershare is happy to inform users of TurboTax® tax preparation software that they are now able to directly import 1099DIV and 1099B tax information for Computershare-administered registered shareholdings, including dividend reinvestment and direct stock purchase plans.

Computershare is the only transfer agent offering immediate import of tax-related data to TurboTax for registered shareholders – providing the same convenience users are accustomed to for their employers’ W-2 forms, as well as their bank and brokerage investment account 1099s.

Frequently Asked Questions

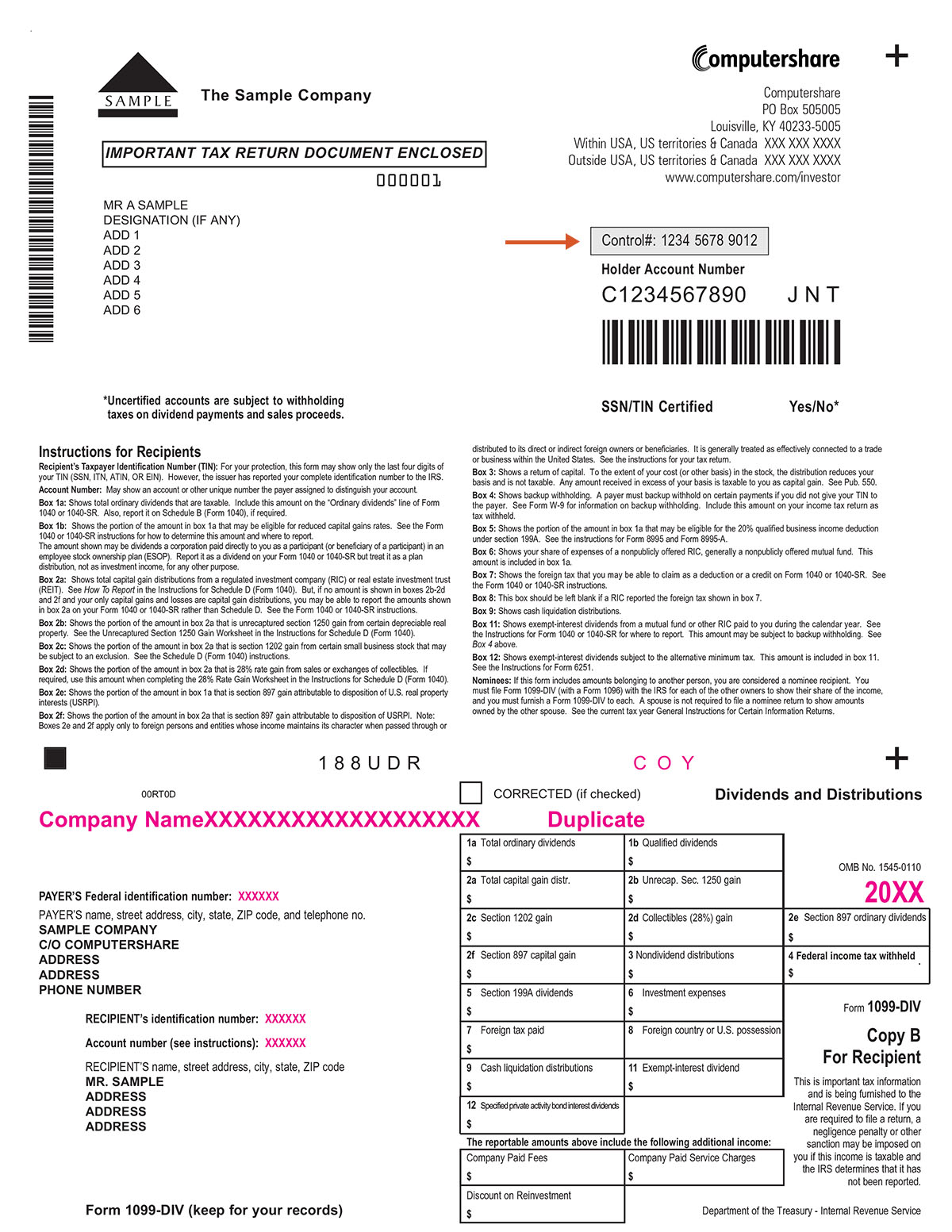

I see that I need a Control Number to access my Computershare tax information. What is the Control Number and where do I find it?

The Control Number is the customer specific identifier located on your tax forms sent by Computershare. The Control number is printed in a shaded box on your tax form(s) provided to you by Computershare.

What types of tax information can be imported to TurboTax from Computershare?

You will be able to directly import 1099DIV and 1099B tax information for Computershare-administered registered shareholdings, including dividend reinvestment and direct stock purchase plans.

What if all tax forms from Computershare are not returned?

Tax forms related to stock options and bonds are not available for import. Computershare will attempt to return all your available tax forms, based upon the account information you provide, however it remains your responsibility to validate that all information is returned. If you require additional forms, they can be accessed via Computershare’s Investor Center or Employee Online websites, depending on the type of holding.

What if one of my holdings has not produced or mailed tax forms?

Information will only be available for import after the forms have been printed and mailed, or otherwise delivered. Please contact Computershare if you are unable to import information related to a holding serviced by Computershare.

I don’t have a Social Security number. What can I do?

The import process is only available to individuals with the information necessary to authenticate and identify their tax information. If you do not have a Social Security number, or are unable to import your information, you may obtain your tax forms through Computershare’s Investor Center or Employee Online websites, depending on the type of holding.

I have questions about TurboTax. Who do I contact?

Information related to assistance with TurboTax software can be found at https://turbotax.intuit.com/best-tax-software/common-questions.jsp. Please understand that Customer Service Representatives at Computershare cannot assist you with most tax related matters, or questions related to the tax software.

When will the TurboTax import service be available?

The TurboTax import service will be available on February 1. Tax forms will not be available for import until they have mailed. 1099DIV forms will be available on February 1. 1099B forms will be available on or after February 18.