Access NHA MBS Information Circulars One Day Before Pool Settlement Date

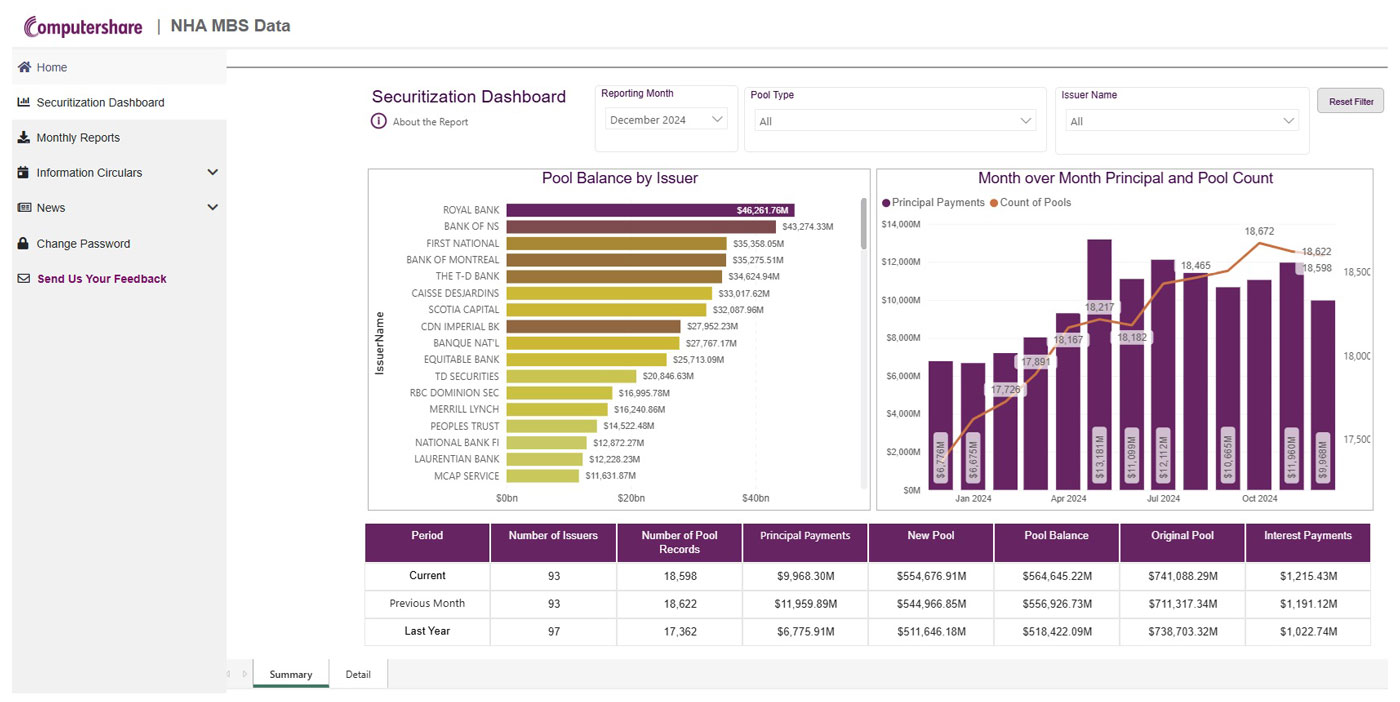

You need to analyze pool issuances related to the Canadian mortgage-backed securities (MBS) market before settlement in order to make sound business decisions.

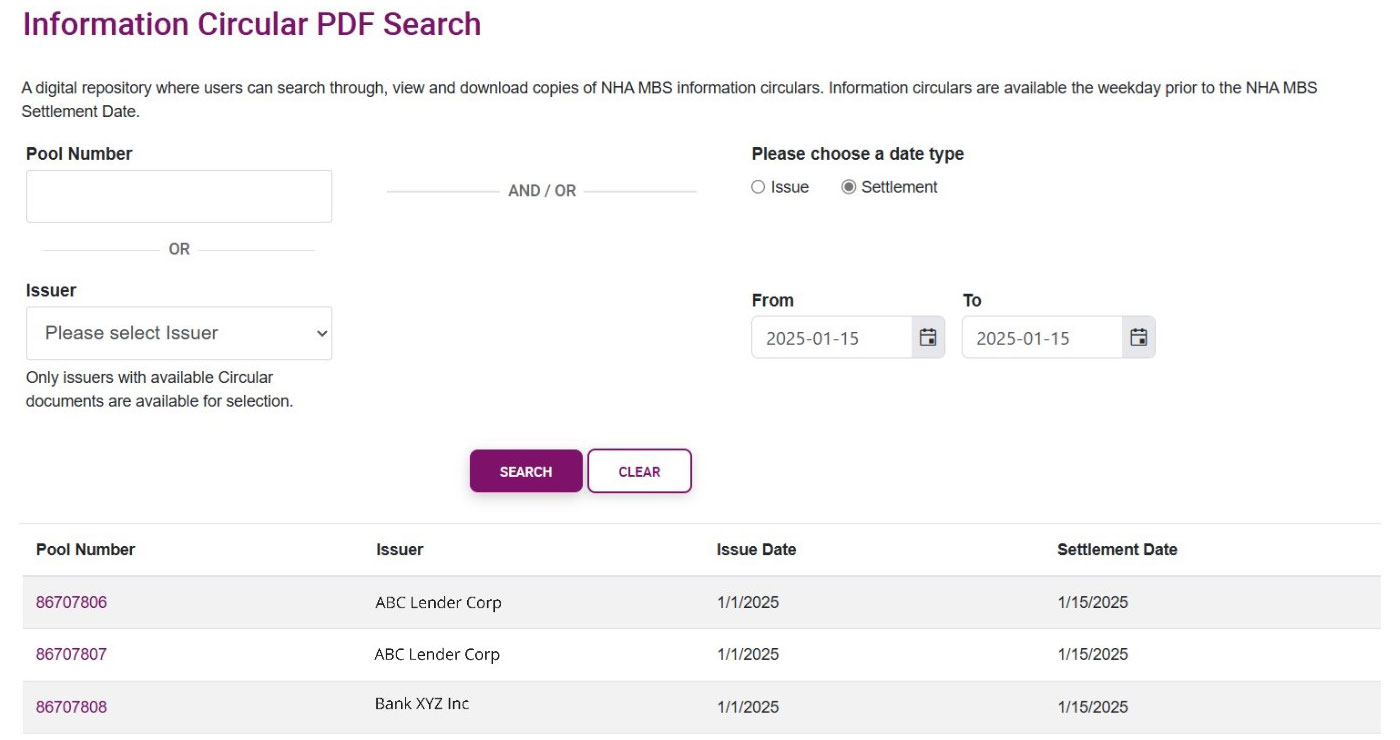

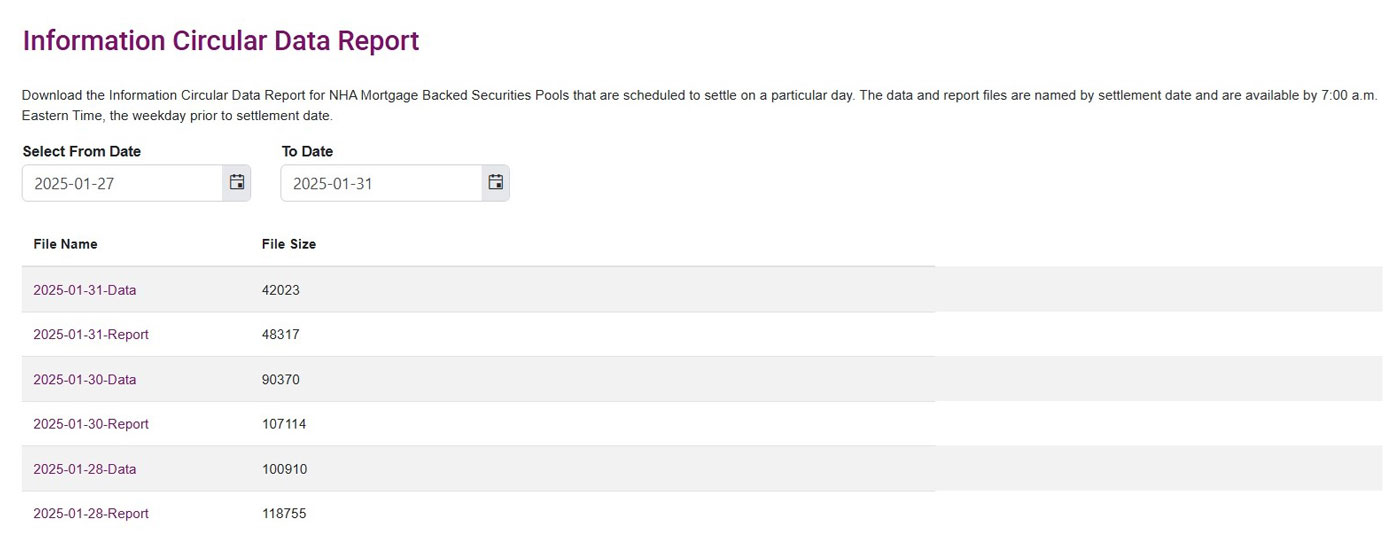

Now, subscribers to the Computershare NHA MBS Data Site can search and download pre-settlement and historical Information Circular PDFs or access pre-settlement Information Circular Data Reports, which can be downloaded or automatically delivered one business day prior to the pool settlement date.