Tax-Free Childcare - your latest update

Childcare voucher scheme deadline looming

With the childcare voucher scheme deadline a matter of weeks away, parents will need to have had a childcare voucher taken from their pay by 4 October 2018* to remain eligible.

Make sure your working parents know your payroll cut-off dates, so they can continue to benefit from childcare vouchers beyond the deadline.

For any parents who miss the payroll cut-off date, your scheme contact can get in touch with us by phone or email (with the parent's details) and ask us to raise an additional order.

We will accept additional orders right up until 1 October, as long as you can get cleared payments to us, so we can award the vouchers by 4 October.

*This is slightly different to what we’ve previously advised, following a recent update from HMRC (our past advice was that parents needed to receive a voucher by 4 October)

Make sure you check out our new video blogs

Leading up to the childcare voucher scheme deadline, we've released six short videos, with the aim of educating parents and employers on their options before and after the deadline.

Videos for you:

Pre-deadline - New and lapsed parents

New parents joining the scheme, or those whose last childcare voucher was more than a year ago must have a voucher taken from their pay before the 4 October.

After the scheme closes - Maternity and paternity leave

If any of your employees are currently on maternity or paternity leave and are already registered on the childcare voucher scheme, it's a good idea to contact them and tell them how they can remain eligible.

After the scheme closes - Keeping eligibility for childcare vouchers

There are a number of reasons why a parent may lose their eligibility for childcare vouchers. One of the main reasons is your working parents allowing more than 12 months to pass since their last childcare voucher.

To share with your employees:

Pre-deadline: Childcare Vouchers vs. Tax-Free Childcare

You currently have the choice of two childcare schemes which can help you with childcare costs. But that's changing shortly so your need to ACT NOW!

Pre-deadline: Sign up to childcare vouchers today

You may be aware that Tax-Free Childcare – or TFC for short – has launched across the country now, and as a result, our childcare voucher scheme will close to new entrants soon. As time is short, and figuring out which scheme is better for you can take a while, we recommend you sign up for childcare vouchers TODAY! Then take your time working out which scheme saves you more money over the long term, until your kids are all grown up.

After the scheme closes: Types of childcare

The cost of childcare can take up a large chunk of your family budget, so make sure you use your childcare vouchers wherever possible. You can use your childcare vouchers in a variety of childcare settings, including breakfast clubs, after school clubs in term-time, and holiday clubs in in the school holidays.

Five employee communication mistakes you should try to avoid

Communicating effectively with your employees can prove to be a tricky balancing act. Too little and you run the risk of having mediocre engagement. Too much and your employees may become tired of constantly hearing from you. In this blog we’ll give you a very quick overview of five employee communication mistakes you should try to avoid.

Register for tickets to Employee Benefits Live 2018

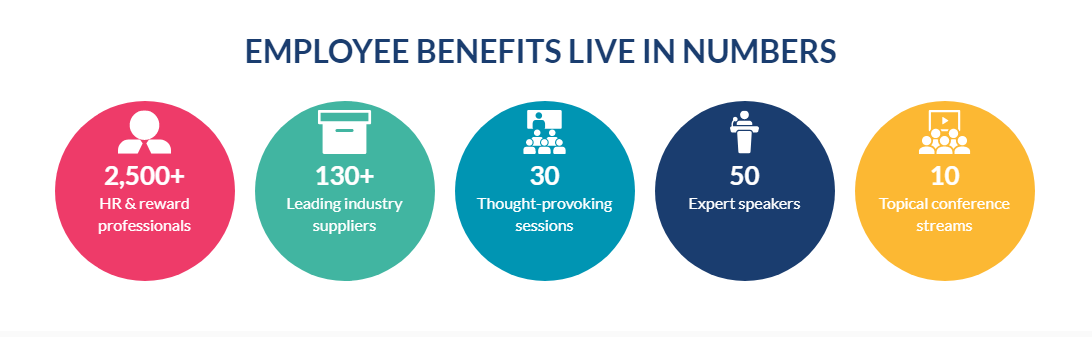

Employee Benefits Live is the largest dedicated reward and benefits event in Europe. Across two jam-packed days, thousands of benefits professionals will descend onto ExCel London, attending thought-provoking sessions, networking with peers and visiting the stands of companies showcasing their services.

Visit their website to find out more and register today for the hottest ticket in town. We hope to see you there!

Is it too early to mention Christmas?

Summer may not be over just yet, and many of your employees will still be enjoying their holidays (here or abroad), but others will be thinking about Christmas and how they’re going to pay for it. In January 7.9 million people said they were likely to fall behind with their finances after spending too much at Christmas. Our Christmas Savings scheme is perfect for those employees looking to take control of their spending, avoid the added stress of credit card debt and ultimately make their money go further. Remember - if you launch a scheme in January, it will be ready for your staff to use at Christmas 2019! Talk to us today about setting a Christmas Savings scheme up for your staff.