Please sign the childcare voucher petition

Hundreds of thousands of working parents stand to lose out if the Childcare Voucher scheme closes to new joiners in April 2018. Childcare Vouchers are the 2nd most popular employee benefit after company pensions. From April 2018 you will no longer be able to offer this to any more employees. Keeping Childcare Vouchers open alongside Tax-Free Childcare will ensure working parents have the greatest choice of financial support to best suit their family’s needs. The petition has generated huge momentum and over 50,000 people have signed it so far. If this reaches 100,000 it will be considered for debate in Parliament and given the strength of support shown for Childcare Vouchers we think there’s a strong chance of keeping it open. But we need your help to get there. Please keep up the momentum and share the petition link with your employees!

Unleash your team's full potential with our Salary Extras platform

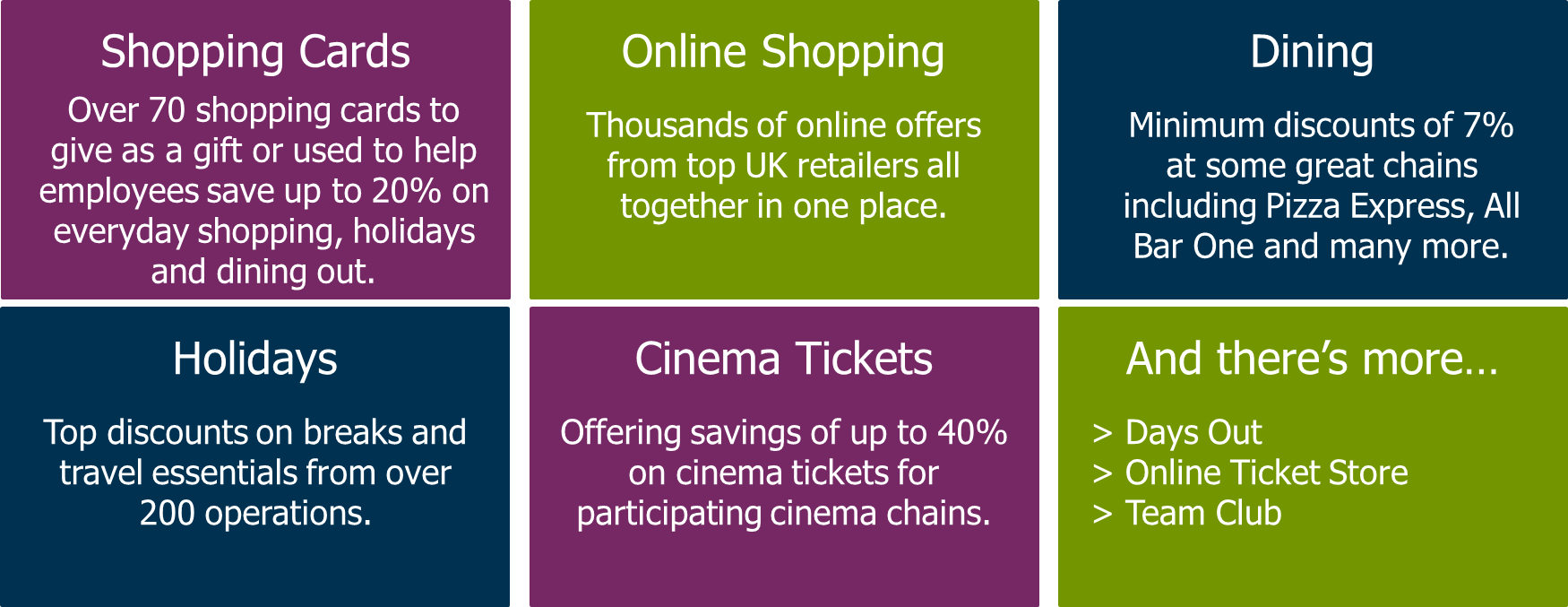

If you've ever thought you're too small to offer your employees the latest in employee benefits, we've got the perfect off-the-shelf (and affordable) solution for you.Our entry level Salary Extras platform has a range of benefits for you to mix and match, including health and financial wellbeing schemes and shopper discounts. And as part of the monthly platform fee you get to add an employee benefit of your own, such as your company pension.

Give your employees the types of benefits they really value, all in one place. And with the built-in Communications Hub, you'll be in control of all your employee communications too.

Health and Financial Wellbeing

Optional Extras

Lifestyle

Designed to save money on everyday essentials as well as those special treats...

Optional Extras

Technology (Computers and/or Mobiles) - With

technology such an essential part of everyday life, it’s well worth offering a

scheme that gives your employees the chance to own the latest tech in an

affordable way.

And as your business grows you can easily add more employee benefits and functionality, such as eligibility criteria, to our Salary Extras platform.

Get in touch with us to find out more.

Maternity leave, childcare vouchers and Tax-Free Childcare – how you can help your employees

Family-friendly employer

Analysis by Employers for Childcare shows that the majority of working families will be better off with childcare vouchers, tax credits or a combination of both, rather than TFC. And some might not even be eligible for TFC.

So now is the perfect time to review your childcare voucher scheme rules, and don't forget the more parents you retain after April 2018 – the longer you'll retain your Employer's NI savings.

12-month eligibility rule

In order to remain eligible for childcare vouchers an employee needs to take a voucher in every rolling 12-month period. If they become ineligible for childcare vouchers after April 2018 then TFC will be their only option, assuming they're eligible. (They won't be able to re-join your childcare voucher scheme as it will have closed to new entrants.)Parents already on the childcare voucher scheme

Do not 'remove' a parent from the scheme whilst they're on maternity leave – they are still registered for childcare vouchers providing they take a voucher in every rolling 12-month period.Maternity leave & Statutory Maternity Pay (SMP)

If you offer an enhanced maternity package, there may be sufficient funds for the employee to continue paying for a childcare voucher from their non-SMP salary (they're not allowed to salary sacrifice their SMP for a childcare voucher).If you only offer SMP you may either continue to pay for the childcare vouchers on your employee's behalf or ask them to stop their childcare voucher order (see our Employment Appeal Tribunal blog from March 2016).

If your employees are required to stop their childcare voucher order, and you allow them to take up to 12 months maternity leave, they may become ineligible for the scheme under the rolling 12-month period rule.

A possible way around this is for you to fund at least one childcare voucher during their maternity leave, or the employee to fund a childcare voucher from one of their paid 'keep in touch days' (ie, from their non-SMP funds). For as little as £20 they remain eligible for the scheme!

First baby

A parent can register for childcare vouchers as soon as their baby is born, even though they're on maternity leave. They will need to place an 'advance order' up to 12 months in advance, for when they return to work (or have a paid 'keep in touch day').If the child is due after April 2018 then TFC will be their only option (assuming they're eligible) as your childcare voucher scheme will have closed to new entrants.

Promote your childcare scheme to all your staff – including the Dads!

There's lot of eligibility criteria for TFC. Assuming a parent is lucky enough to be eligible for both schemes, and to give them the luxury of time, we recommend they register for childcare vouchers before April 2018.They can then take their time working out which scheme is best for them and their family - it's important to remember that once they've joined the TFC scheme (and made their first payment), they can't switch to childcare vouchers at a later date. But they can switch from childcare vouchers to TFC, even after April 2018.

If working mums and dads don't register for childcare vouchers before April 2018 then TFC will be their only option (assuming they're eligible) as your childcare voucher scheme will have closed to new entrants.

Please visit our Give Yourself A Choice website for more information about TFC.

If, having looked at the website, you still have questions around TFC, please email us at tfc@computershare.co.uk quoting your company name and Relationship Manager (if known), and we'll do our best to help.

In other news

Gender Pay Gap Reporting - are you ready for your 'snapshot'?

We’ll also be exhibiting at The Scottish Business Exhibition on 1 and 2 November at the SECC in Glasgow.

After the success of Employee Benefits Live, we'll be returning to Olympia London for The Great British Business Show on 16 and 17 November.