Insurance providers rely on essential communications to convey crucial information to their customers. These communications contain important details necessary for customers to ensure they are adequately covered by the right policy.

A seamless communication experience not only highlights the true value of the policy during critical moments but also reinforces the customer’s confidence in their provider choice. We conducted research to unearth the value essential communications hold for both insurance providers and customers.

Our key highlights below deliver insights into how Canadian insurance customers perceive these essential communications, pinpoint areas for improvement, and enhance the overall communication and delivery experience.

“Essential communications are a positive aspect of my life, as they keep me informed on policy changes.”

— Female, Gen X

87%

of Canadian insurance customers value essential communications from their provider. This is an increase of 6% from our previous research conducted in 2021.

As insurance customers get older, they increasingly value essential communications from their insurance providers.

We asked respondents what movie genre best reflects their insurance provider’s communications.

THEY CHOSE DRAMA!

This was an offbeat question, but the results provided some very interesting insights.

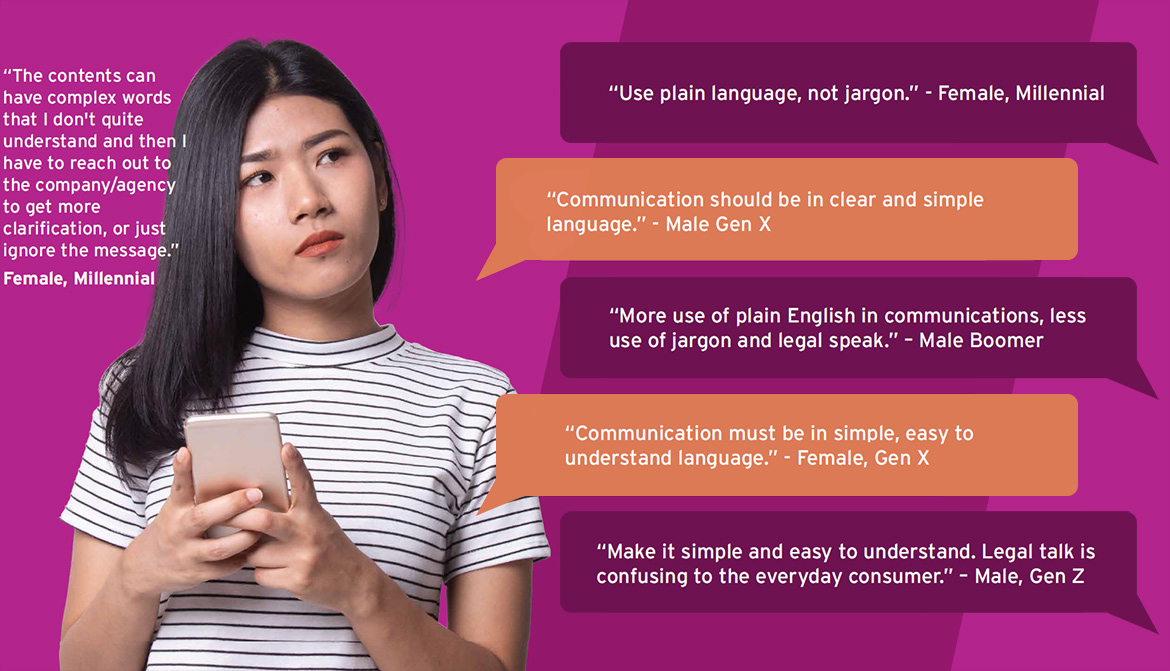

Choosing a drama means that consumers often view essential communications such as policy documents, renewal notices, and claims information with mixed emotions.

They may experience stress or confusion due to the complexity of insurance-related terminology and processes. Claims-related communications are of a particular focus here, as they are most often received when consumers are in stressful situations.

What can you do to improve this experience?

Simplify communications by using plain language to make them easier for customers to understand, especially the explanation of coverage, and the claims process.

Making communications empathetic, clear, and user-friendly can improve trust and loyalty while reducing customer service enquiries.

Digital channels can be leveraged to provide policyholders with easy access to policy details, claim status, online payment for renewal, and FAQs.

“Ensure that the communication is simple, straightforward, and well-organized. This means avoiding technical jargon and using plain language that is easy to understand.”

— Male, Gen X

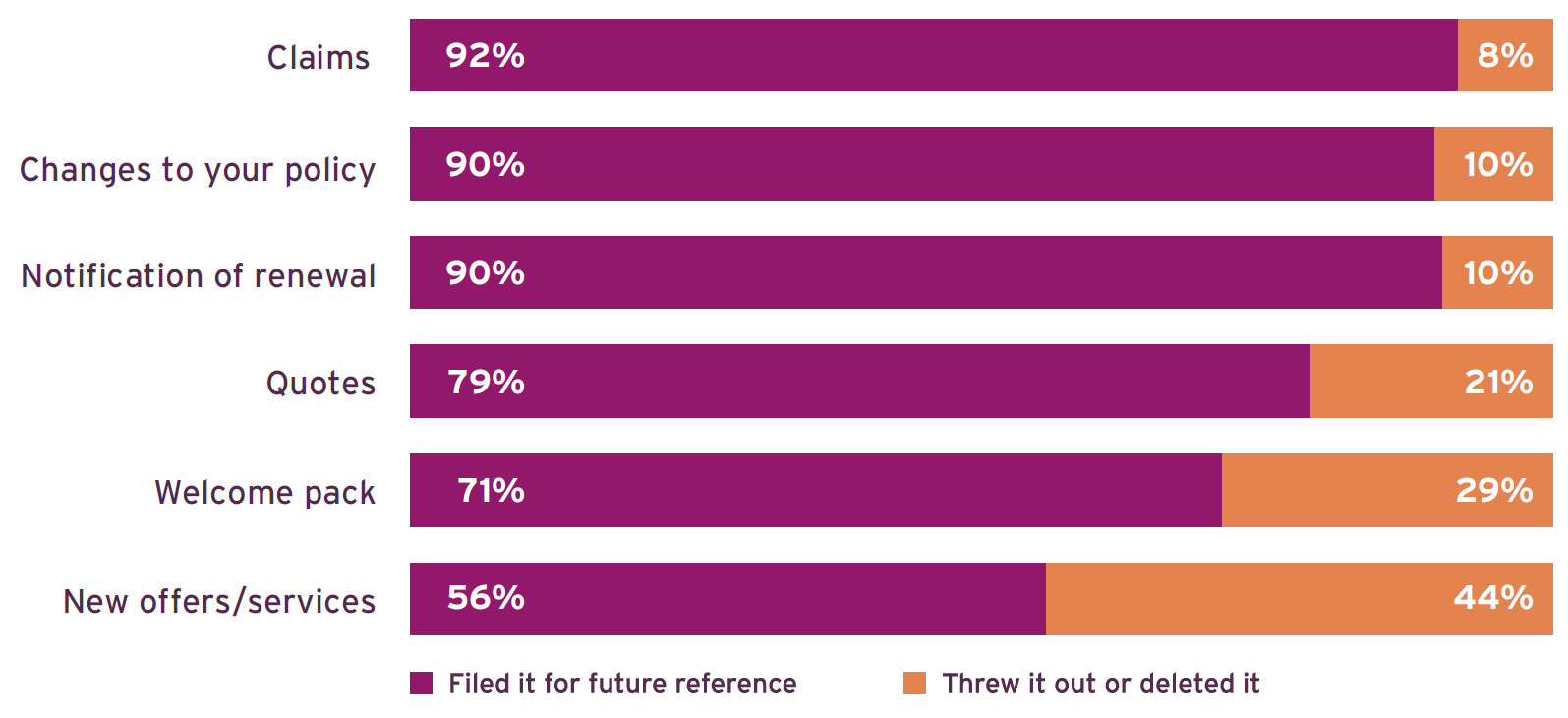

What do consumers do with communications after reading them?

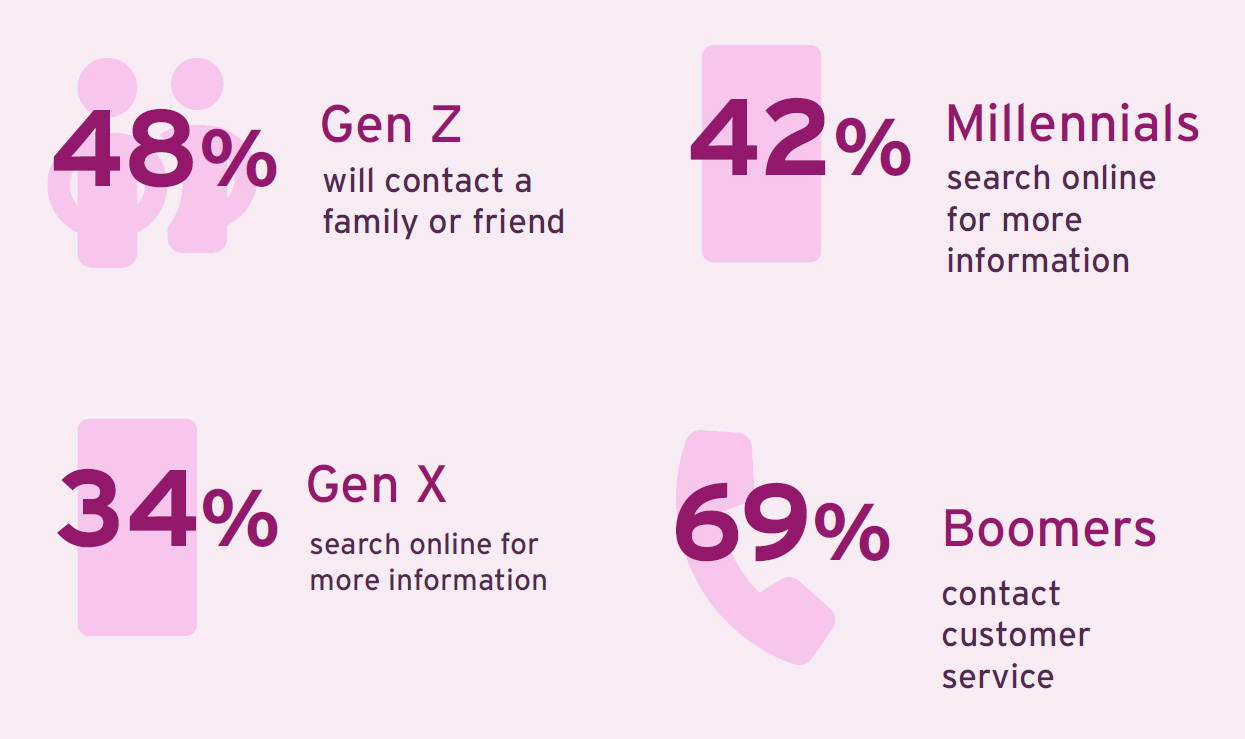

When communications are unclear, more than half of consumers will contact customer service.

33%

of customers occasionally

have trouble reading and

understanding communications

from their insurance provider.

One of the most common

comments about improving

communications was simplifying

the language used.

We are Computershare Communication Services

We exist to transform essential communications for our clients. Communications that are not only complex, but highly regulated. Communications with the power to build strong connections with customers.

Many challenges get in the way of optimum communications: new technologies, regulation changes, data challenges, different stakeholder objectives, cost pressures, changing customer preferences, and complex implementation.

With 30+ years of experience of functional and industry expertise and unparalleled insights, we seamlessly navigate these challenges to unlock value across your essential communications.

When you work with our specialists, you can be confident your communications will meet your business needs.

Survey details:

Computershare engaged The Evolved Group to undertake research into consumer attitudes towards essential communications. The information presented above specifically focuses on 401 Canadian respondents who recently had interactions with their insurance provider.

© Computershare Group 2024. Computershare and the Computershare logo are registered trade marks of Computershare Limited.

No part of this document may be reproduced, by any means, without the prior and express written consent of Computershare.

The content of this document is intended to provide a general overview of the relevant subject matter and is not intended as advice of any kind. The document includes information that is based on key findings from the consumer study conducted by Computershare and The Evolved Group, and which is subject to the scope, qualifications, assumptions and limitations and other parameters contained in that study.

The Computershare Group accepts no responsibility for the accuracy or completeness of any information contained in this document. It is important that you seek independent professional advice relating to the subject matter of this document before relying on it. The Computershare Group reserves its rights to amend this document at any time.